Today we will talk about who has been making waves in the forex trading community. You might have heard his name before or maybe you have not, but if you are serious about trading then you need to know who the Inner Circle Trader is. Because he will teach you ICT trading and ICT strategies.

So who is Inner Circle Trader? Well, he is a trader, his name is Michael Huddleston he has been in the trading game for over 30 years and is the founder of ICT trading concepts and ICT strategies. He has made millions of dollars trading the markets and also changed the lives of traders in the new generation, and he has gained a huge following of traders who swear by his methods.

The Inner Circle Trader or ICT for short is known for his approach to trading. but what he does offer is a wealth of knowledge and experience that can help you become a better trader.

Why Is ICT Trading Important?

If you are looking for someone with a proven track record of success in the forex trading markets, then ICT is your guy. He is not some internet guru who claims to have all the answers. he is a real trader who has been in the trenches and is willing to share his knowledge with others.

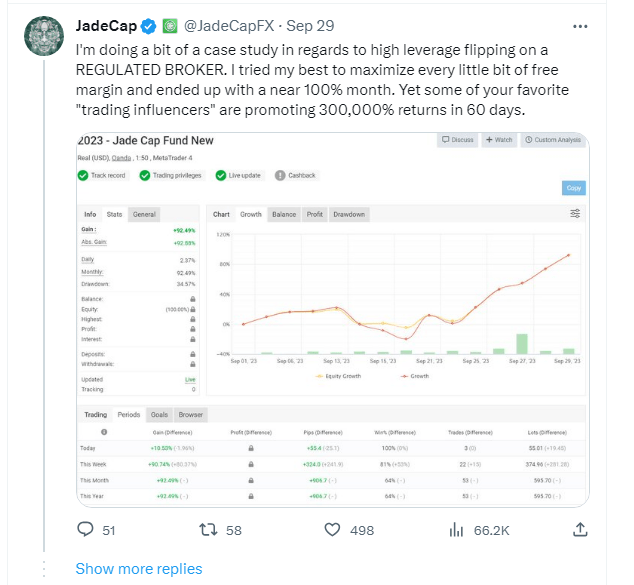

ICT’s students bashing the markets and getting top 1 in prop firm leaderboards. In the picture below he is one of that’s students and has been making consistent profits in markets for the last 10 years. You can also join their community to get more exposure in your trading journey.

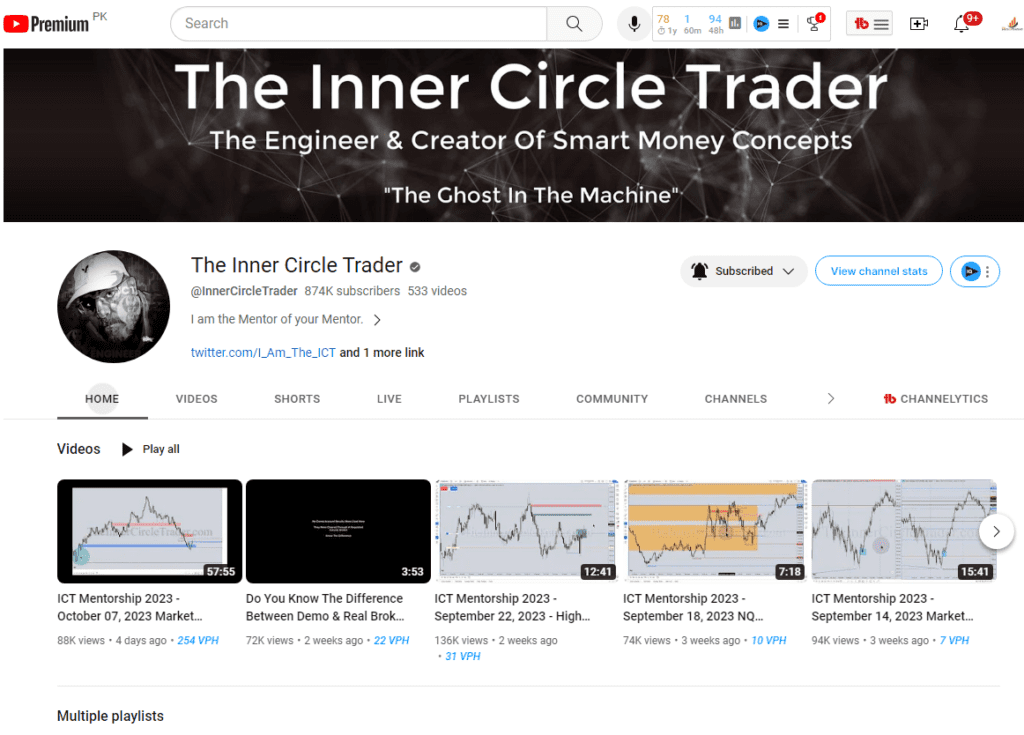

Following the Inner Circle trader can help you avoid common trading mistakes and give you the tools you need to succeed. So How can you learn from ICT? Well, there are a few ways. First, you can check out his YouTube channel where he offers a list of ICT strategies free of cost.

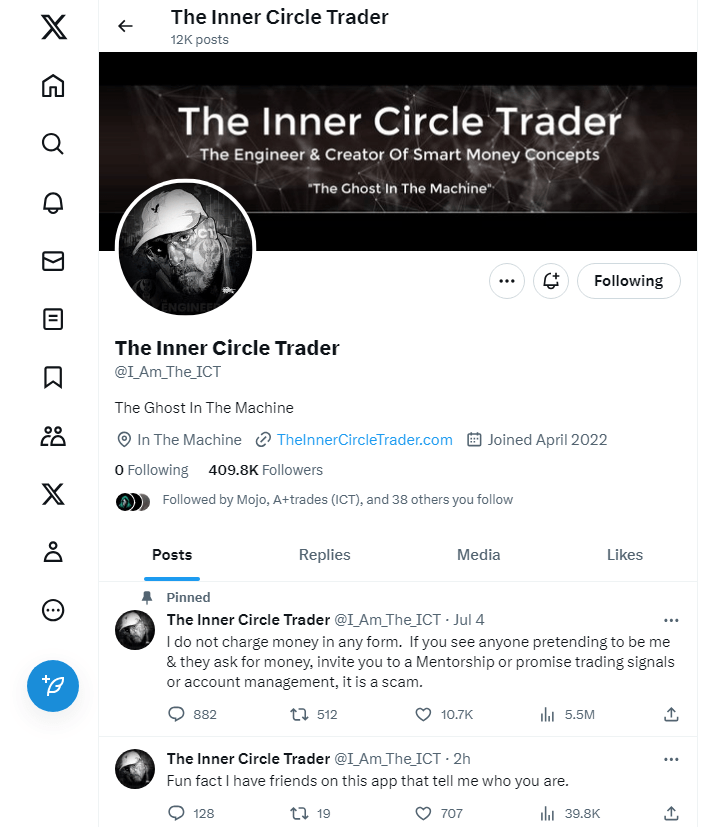

He also offers real-time guidance for traders on his Twitter account. On Twitter, he shares his thoughts on markets and interacts with his followers.

Links:

Youtube: https://www.youtube.com/@InnerCircleTrader

Twitter: https://twitter.com/I_Am_The_ICT

List of Powerful ict trading strategies

- Silver Bullet

- Order Block

- ICT 2022 Model

Before digging into these powerful ICT trading strategies we need about the main methodology of ICT concepts so that you can understand them better. Trust me you are not going to waste your time by reading this article. ICT methodology is based on 7 seven techniques that you must know before joining ict mentorship.

Here are 7 important components for ict concepts:

- Inducement

- Balanced Price Range

- Optimal Trade Entry

- Fair Value Gaps

- Liquidity

- Market Structure Shifts

- Displacement

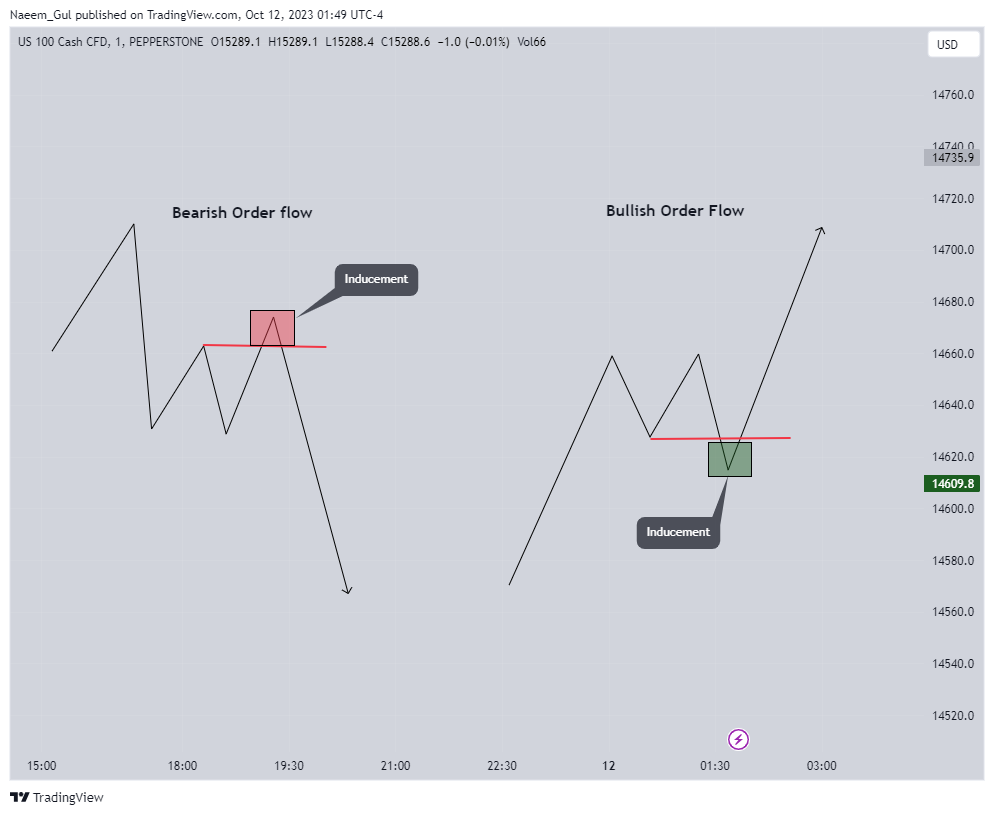

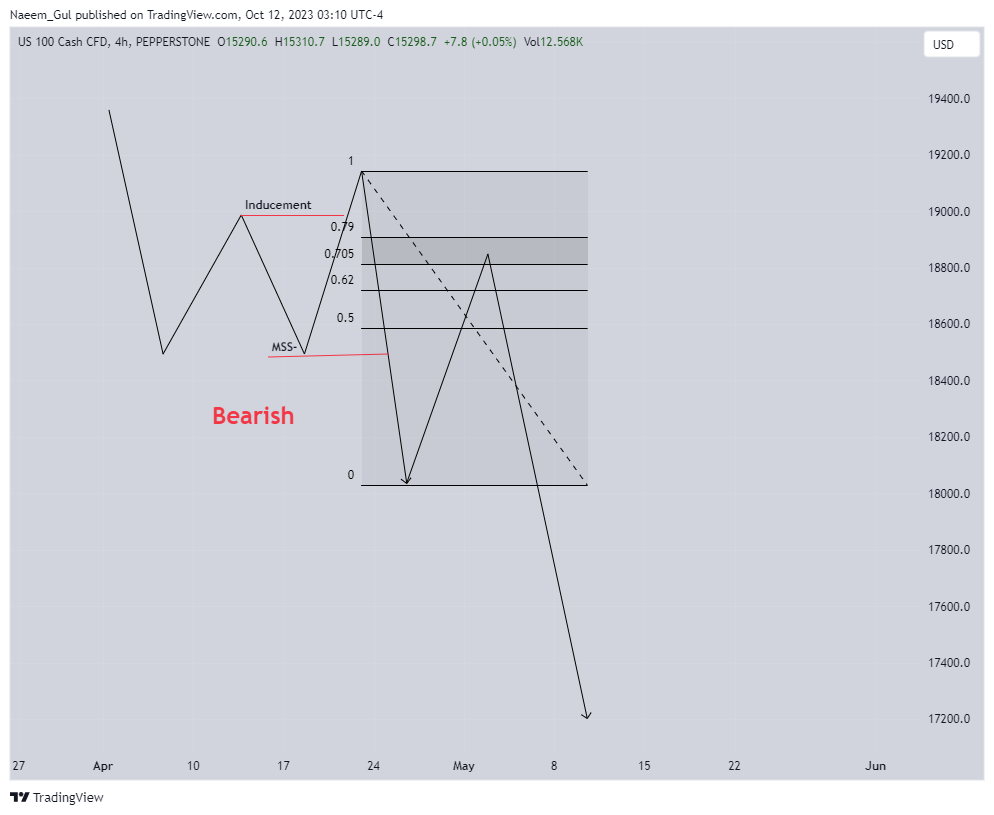

Inducement:

Inducement is essentially a move that induces buyers or sellers into the market. this tricky move is also called manipulation. You can identify inducement in the strong Bullish and Bearish trends. Inducement is the move of price which causes traders to trick into the wrong side of the market. ICT’s concepts use this inducement factor in every single ICT strategy.

Inducement occurs if, in the bearish trend, the market moves to the upside and breaks a higher time frame (HTF) resistance and tricks traders into buying trades but in reality, it’s going lower, this process is called inducement.

Here are some examples:

Balanced Price range

This concept is based on FVG overlapping. When a bullish fair value gap overlaps a bearish fair value gap and vice versa, this is called a balanced price range in short BPR. Traders use this to give more exposure to their trades.

Here are some examples:

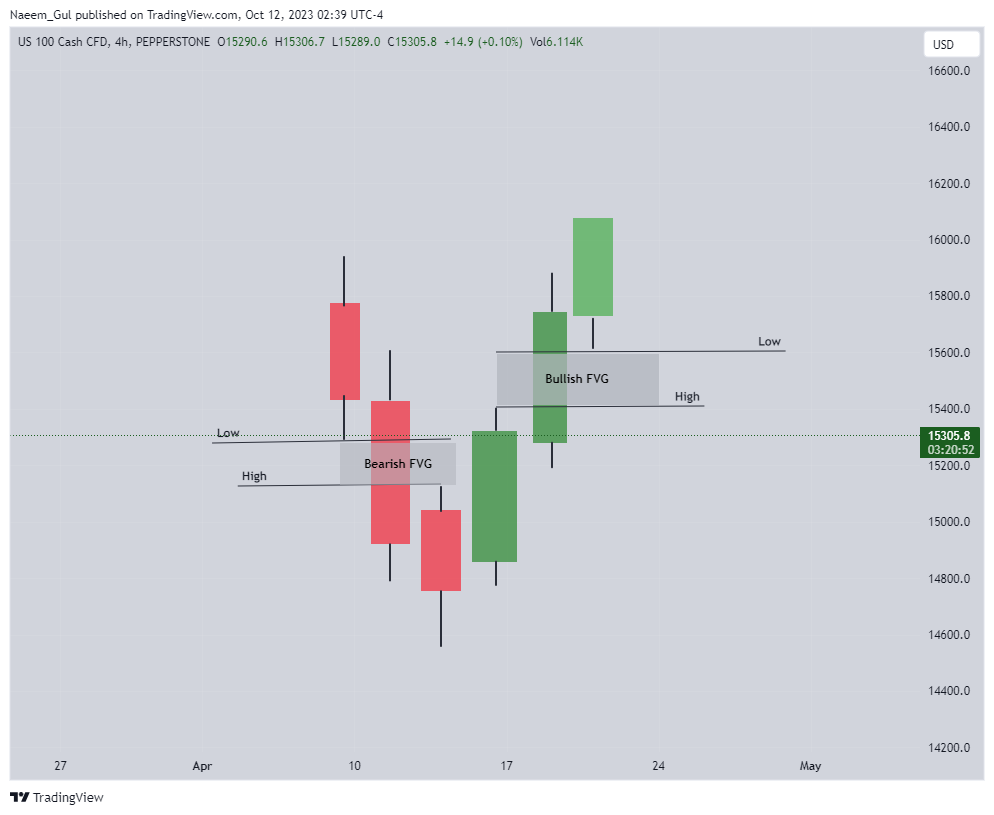

Fair Value Gaps (FVG)

What is a fair value gap? This question is in every beginner ict trader’s mouth.

A Bearish FVG is a three-candlestick pattern where the first candle’s low does not overlap the third candle’s high and the Bullish ict fair value gap is where the first candle’s high does not overlap with the third candle’s low.

Here are some examples:

Optimal Trade Entry

Optimal trade entry pattern usually ict traders use Fibonacci levels to get their entry techniques. This pattern occurs when the market induces and then gives a shift in the market structure. It’s the most popular pattern used in ICT trading and ICT trading strategies.

Here are Examples:

Liquidity

Liquidity refers to old highs and old lows. The old high or old highs liquidity is called buy-side liquidity and the old low or lows is called sell-side liquidity. ICT created these terms.

The liquidity where the majority of traders put their stop loss is called liquidity. Liquidity usually rests above and below swing points. This methodology of ICT is also one of the most important components used by SMC traders. The market price is attracted to these points where liquidity is resting. So you can use that component to enhance ICT trading methodology.

Here is an example:

In this weekly chart, you can see price is reversing from swing points after taking Liquidity. In these zones, most of the ICT traders find their entries.

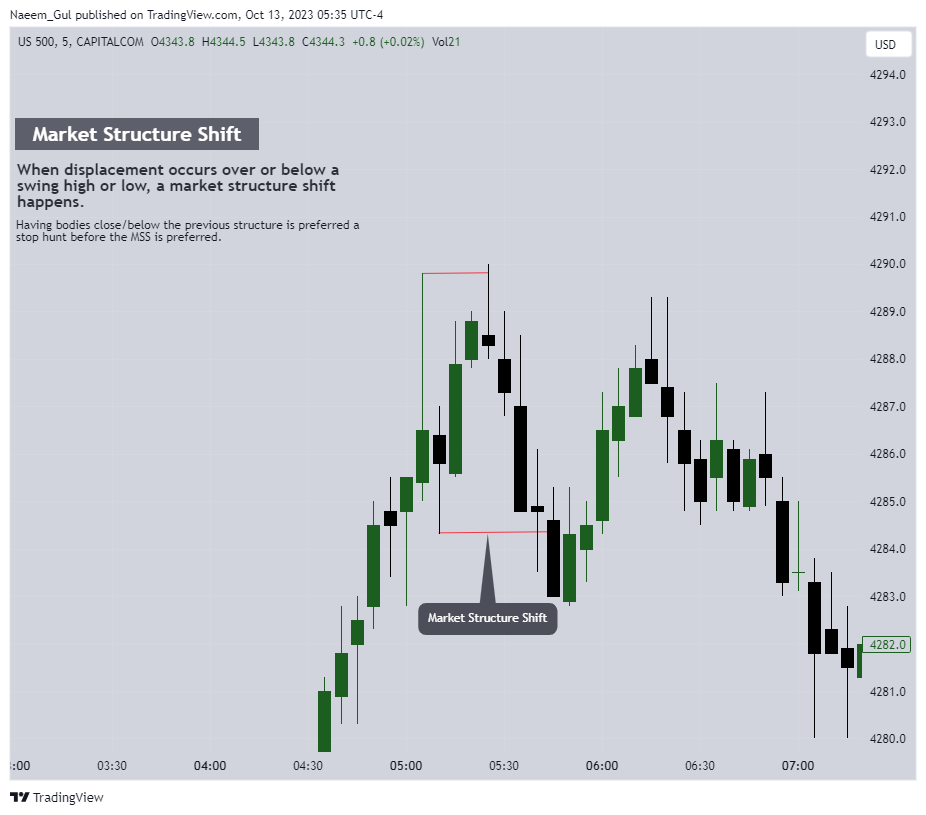

Market Structure Shift

Market structure shifts are important because they show us where the structure is shifting from bullish to bearish or bearish to bullish. Let me show an example of a market structure shift with annotations on the chart. ICT concepts or ICT trading methodology must use this market structure shift in almost 90% of ICT trading strategies.

This is a bearish market structure shift example. I hope you will get it, I showed you most simplest.

Here is the Bullish Market Structure Shift example one the very simplest form.

Displacement

ICT’s mentorship teaches you to focus on displacement but a lot of people don’t realize what you can take out of the lack of displacement. Displacement is just large aggressive with closes in the high or the low.

You should be finding displacement on the charts when the market breaks a low or high, in these zones where liquidity sweeps if you look for displacement that will be much more beneficial instead of finding it here and there.

Here Is an Example of Bullish Displacement:

Here Is an example of Bearish Displacement:

Sequence of ICT Concepts Below:

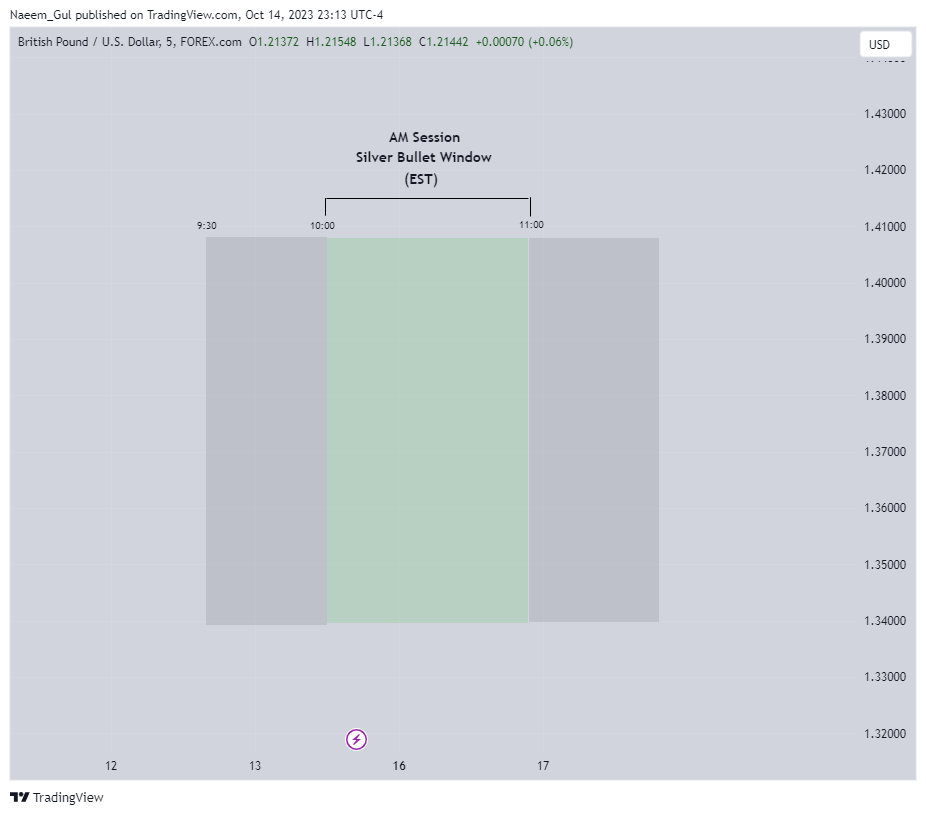

Silver Bullet ICt Trading Strategy

This ICT trading strategy is one of the most popular ICT Trading Strategies in 2022 and 2023. This strategy is used by a lot of traders who are new to learning ICT concepts. This ict strategy is totally mechanical strategy.

Beginners loved this strategy because it’s so easy to learn and also in this strategy, This ict strategy is totally mechanical strategy. we don’t need any daily bias for trades in the forex or future market. In this paragraph, we are going to cover the ICT silver bullet strategy and its components.

Components of Silver Bullet Strategy

- Time

- Fair Value Gap ( FVG )

- 1 minute time frame

- Liquidity (Hourly high or low)

- MSS ( market structure shift )

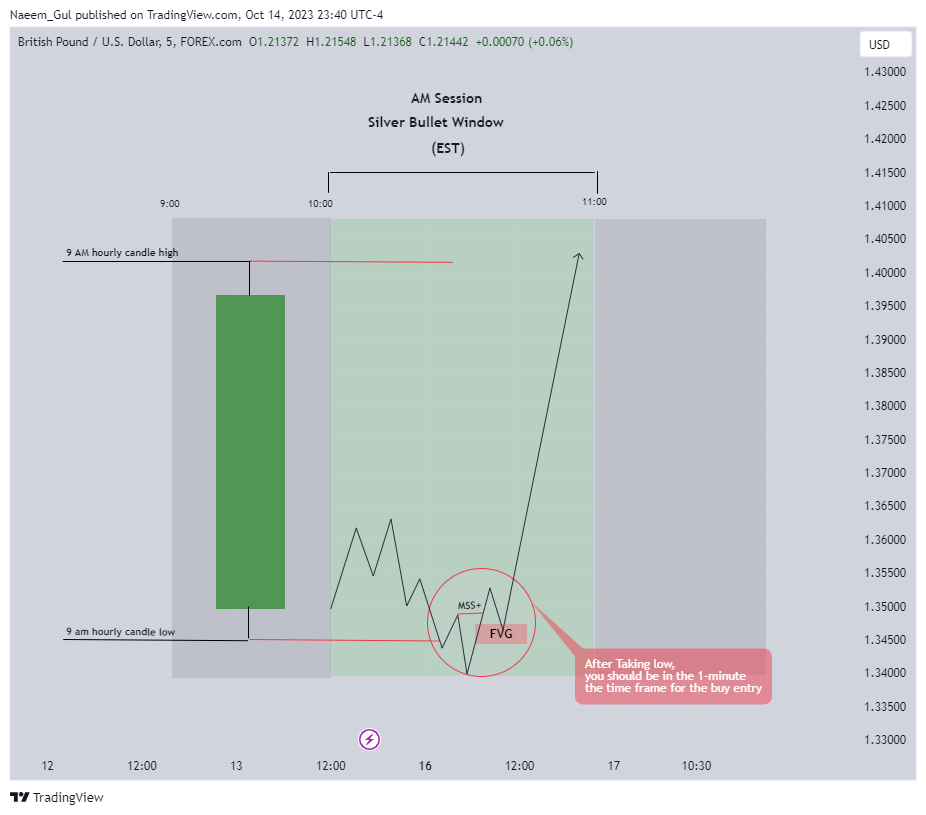

The first component of this ict trading strategy is time, you should be focusing on 10 a.m. to 11 a.m. New York local time or AM session for the silver bullet entry. This is the only time window when you should be focusing on taking entries if it appears between 10 a.m. to 11 a.m. New York local time. Here is an example of the time window.

For the framework, I will use the previous hourly candle’s high and low to frame reversals, so the first thing you should do when you get to the charts is once 10 AM hits you will use the previous hourly candle’s high and low for this ict trading strategy.

When 10 AM starts you should quickly mark the previous candle’s high and low and wait for the market price to take liquidity from one side. When it takes liquidity from one side for example we suppose it takes buy-side liquidity (the previous candle’s high). After that you quickly go to the 1-minute time frame and look for bearish FVG, once it occurs you put your entry on the first fair value gap and market structure shift (MSS).

When you take sell entry then your target should be the previous hour candle’s low. If you take buy entry then your target should be the previous hour candle’s high.

Here is an example of a full framework of Sell trade:

Here is an example of an ICT trading strategy buy entry:

Backtest this strategy on your own for at least 3 months . Then check the Win-rate if you are satisfied with the ict trading strategy Win-rate then you can use that model for your trading journey.